CDR’s 15th Annual Global IR Survey

The bags are being packed this weekend with warm clothing and the sub-zero Davos temperatures prepared for. This year’s WEF event will see over 100 governments in attendance alongside over 1000 corporate partners, society leaders, social entrepreneurs and many major international organisations. It comes alongside the continuing Ukraine war, Israel’s war on Hamas and a still uncertain financial climate. As with last year’s event and also the recent COP28 summit, there is a strong presence expected from the United Arab Emirates, the Kingdom of Saudi Arabia and other Gulf nations, further demonstrating their efforts to be recognised as global leaders of the future.

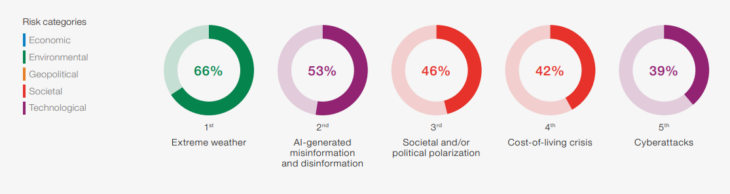

The recently released Global Risks Report 2024, published by the World Economic Forum, concludes how the biggest global threats in the next two years are extreme weather, AI-generated misinformation and disinformation, societal and/or political polarization, the cost-of-living crisis and cyber-attacks.

This year’s event leads with the thematic focus on “Rebuilding Trust”, especially with an ever-growing expectation of global leaders to demonstrate how – through strategic collaboration – they can support building a better society that is more resilient to any future challenges.

Agenda for this year’s event

The WEF 2024’s programme revolves around four critical themes:

Media intelligence

The vast majority of reporters attending WEF have a business, economics and banking focus. As such, the expected areas of interest among the confirmed media attendees are more aligned with finance-related topics but technology, renewable energy and climate-focused discussions will continue to remain at the forefront. That said, we’ve also learned from POLITICO that most of their events at WEF this year are focused on AI rather than topics covered previously such as climate. Additionally, a number of trade journalists are not attending this year, so we should expect a reduction in media coverage live from the event – with many publications covering from afar.

Key events to be aware of

Alongside special addresses on Tuesday by Li Qiang, Premier of the People’s Republic of China, Ursula von der Leyen, President of the European Commission and Volodymyr Zelenskyy, President of Ukraine, there are also numerous events that may be of interest. Tuesday also sees a session entitled Next Steps for Digital Worlds, featuring Sir Martin Sorrell, which will look at the metaverse and what gaps are needed to be closed to go from boundless opportunities to realizing the metaverse potential, as well as a session entitled Software.gov which will focus on how the private sector and governments can work together to achieve effective cooperation to help realise the changing digital demands of the global population. On the climate front, there is a session entitled Transforming Energy Demand, which will look at what can companies and governments do to enable economic growth with less energy?

Wednesday 17th sees panel discussions around Cybersecurity Futures which will look at the key driving forces that will shape the long-term future of cybersecurity and how they can inform leaders’ strategic plans across the globe and also a panel called The Battle for Chips which will look at the semiconductor industry and what impact restrictions will have on both innovation and the competitive landscape in advanced chipmaking. Keynote speeches for the day will come from António Guterres, Secretary-General, United Nations and Emmanuel Macron, the President of France. Another session, titled Tripling Renewables: Make It Rapid and Responsible and which focuses on what strategies leaders can deploy to make the transition to renewable energy rapid and responsible, will be of particular interest following COP28.

Thursday’s session entitled Technology in a Turbulent World which assesses how technology can amplify humanity and features panelists such as Jeremy Hunt, the UK Chancellor and Sam Altman, CEO of OpenAI, may be of interest and we will be following this closely. We will also be following the session called Where Global Commerce Is Headed, which looks at the changing patterns of global trade.

We will be following events in Davos closely as we support our clients there. Preparations for Davos 2025 will begin as soon as this year’s event ends so please get in touch if we can be of support.

However, even this money-orientated Russian oligarch is denying the supremacy of money in the beautiful game. His comments of course allude to a certain stakeholder which is unique to the business of sports and can wield ultimate power, the fan.

With the increasingly blurred lines between business and sport, and the prevalent ownership of sports teams by private equity, businessmen and royal families alike, a multitude of new stakeholder groups need to be considered for ongoing engagement.

Sport has a unique, varied and impassioned group of stakeholders. Fans, pundits, broadcasters, advertisers, players and even politicians all have their views, and are often vocal with it. In the world of sport, each of these groups can arguably influence business strategy and decisions more forcefully and effectively than the traditional board member, consumer or banker. Investors therefore need to be seen to give their views due consideration in every decision being made.

The common perception of the David and Goliath relationship between a sports club’s owners and their various stakeholders is often overplayed, often to the detriment of these owners.

A prime example of this was the campaign which led to the demise of the proposed European Super League back in 2021. This movement was led by a combination of pundits, journalists, politicians and fans. Influential football media figures such as Gary Neville, Gary Lineker and Roy Keane rallied hard against the proposals, using traditional and social media to do so. These concerns were mirrored by politicians, with then British Prime Minister Boris Johnson stating that “plans for a European Super League would be very damaging for football and we support football authorities in taking action.” Financially the benefits of such an agreement in any other business sector would have meant that criticism of the deal would have been few and far between.

Fan protests are often more unconventional than traditional stakeholders raising a grievance. However, even in instances where the protest is outright amusing, they tend to be incredibly effective.

A perfect example of this occurred in 2012, then Premier League team Blackburn Rovers’ fans protested against their chairman by releasing a chicken (with poultry being the primary business of the club’s owner) draped in a flag of the club’s colours, halting the game live, which was being watched by millions of people across the globe. This humorous and visually striking image of a chicken pecking on the pitch of a Premier League club is still talked of today.

Another peculiarity of stakeholders in sport is that they are part of the product itself, particularly players and fans. This influence has allowed players to obtain very favourable partnerships with sporting organisations and advertisers. The most notable case of this is all the way back in 1984, with Michael Jordan’s groundbreaking endorsement deal with Nike. Creating the “Air Jordan” brand gave the young star a 5% stake, which nearly 40 years later has amassed Jordan over $1.3 billion.

This player power has continued into the modern day and can be seen through Lionel Messi joining Major League Soccer team Inter Miami. The contract offered to the Argentine this year provided more than just a salary. The deal reportedly includes profit sharing with two of MLS’s biggest commercial partners, Apple and Adidas as well as an option to purchase a minority stake in the club.

The convergence between business and sport is a trend which is only gathering pace. The revenue generated by the global sports industry is expected to grow at a compound annual growth rate of 5.2% over the next 4 years, forecast to reach $487bn in 2027. Navigating the difficult landscape of sports ownership in 2023 is an arduous experience, and investors neglect the views of sports stakeholders at their own peril.

Even after the huge commercialisation of sport, it is not overly sentimental to suggest that money is not as powerful a force as in other industries. This means that the importance of an advisor bench who knows the landscape and can take a comprehensive overview of engaging with each sport’s stakeholders is paramount to the long-term success of an investment.

In the quest for a sustainable future, the concept of climate dividends has slowly begun to emerge. They represent a mechanism that holds the potential to drive meaningful change by addressing both environmental concerns and economic inequality. Surprisingly, this innovative approach remains relatively unknown in the mainstream discourse surrounding sustainability.

Climate dividends involve returning carbon pricing revenues to citizens, linking environmental policy with individual economic well-being. This spurs sustainable consumption, innovation, and circular economy practices, bridging environmental goals with macroeconomic shift.

Climate dividends can be seen as a form of universal basic income derived from the revenues generated by carbon pricing or carbon taxation. The basic premise aims to be straightforward: as society transitions to a low-carbon economy, the carbon emissions of industries and individuals are regulated through pricing mechanisms. The revenues collected from these carbon fees are then distributed equitably to citizens in the form of dividends. This approach seeks to alleviate the disproportionate burdens faced by low-income households during the transition to a greener future.

These climate dividends lack awareness due to the complexity of the topic and its relatively recent emergence. While carbon pricing and carbon taxation have gained some attention, the concept of distributing the revenue back to citizens has yet to gain significant traction in mainstream discourse. Furthermore, it takes a backseat to discussions surrounding other climate policies and initiatives, such as renewable energy investments or emissions reduction targets.

Taking a step back, it’s worth noting the current pushback against the net-zero agenda. Recent events have prompted political and international scepticism around net-zero commitments. Across Europe, the resistance to green policies is fierce. Poland is suing the EU over its plans to the increase in the bloc’s emissions reductions target, Germany has blocked a ban on new combustion engines to protect the industry and the BBB Party in the Netherlands is in opposition to the government’s plans to drastically cut nitrogen pollution on farms, to name but a few.

As the EU aims to implement its Green Deal legislation and achieve net zero emissions, concerns over economic competitiveness and the capacity to absorb new laws have resulted in calls for a “regulatory break”. Ursula von der Leyen, European Commission President has recently stated the EU needs to assess its capacity to absorb multiple new environmental laws.

From a political standpoint, carbon pricing itself can be a controversial issue, as it requires consensus-building and economically, concerns arise regarding the potential impact of carbon pricing and dividends on business competitiveness, job creation, and economic growth.

These factors, combined with lobbying efforts, can hinder their widespread adoption: climate dividends might face similar political and economic hurdles, especially considering their limited recognition.

Climate dividends could be a powerful tool for organisations to demonstrate their commitment to sustainability and drive value creation. By actively supporting their implementation, organisations can showcase their dedication to carbon neutrality and attaining a sustainable future.

The pros of implementing a climate dividend scheme include the funding of renewables, which in turn will generate revenue for green initiatives and renewable projects and addressing inequality for low-income households during the transition to a low-carbon economy. Designing the dividend distribution system to ensure that these households benefit proportionately and are not adversely affected by the transition is critical. Overall, setting up fair and efficient dividend systems can be complex.

Climate dividends should be viewed within the macroeconomic shift toward sustainable growth. As economies embrace low-carbon strategies, this approach aligns with evolving economic models by directly linking environmental policies to consumer purchasing power. They can incentivise sustainable consumption, stimulate green innovation, and encourage circular business models, fostering economic prosperity.

From an organisational perspective, getting ahead of the curve and incorporating climate dividends in a company’s sustainability strategy can enhance its reputation among stakeholders and the public. Consumers would change their behaviours more if they can see the data and the impact.

Climate dividends offer a unique and holistic approach to addressing both environmental and social challenges as we strive for a more sustainable future. The impact isn’t just financial however, the incentive to change behaviours shouldn’t just be about meeting standards, but rather organisations’ willingness to play a pivotal role in driving positive change, supporting economic growth, and fostering a more equitable and sustainable world. We don’t yet know whether climate dividends will pick up steam in the mainstream, but I believe it is an idea that could eventually become a prominent and integral part of the sustainability landscape.

The integration of AI into IR offers unprecedented potential for enhancing efficiency, accuracy, and strategic decision-making. Yet, the path to fully harnessing AI’s benefits is accompanied by a trail of challenges that must be navigated with astuteness and adaptability.

A recent pulse survey conducted by Citigate Dewe Rogerson gives us an insight into how Investor Relations Officers (IROs) are approaching the adoption of AI. Despite the furore surrounding generative AI tools, like Chat GPT, over 50% of our respondents haven’t yet explored such tools (but do have the intention to). And, while around a quarter are already using generative AI in their roles, over 15% of respondents noted employer restrictions as the reason for not utilising AI tools.

The survey also reveals that while most IROs recognise that AI technology can support them in their role, they are yet to realise the full potential of AI and risk missing opportunities in an increasingly AI-driven investment landscape.

AI in investor relations: Beyond the mundane

In previous CDR insights, my colleagues have noted that AI in IR, and indeed communications more widely, primarily serves as a means to delegate mundane tasks and elevate efficiency. It was therefore unsurprising to see the survey confirm this suspicion.

However, a closer examination reveals the diverse dimensions in which AI tools are wielded by some IROs. From generating initial drafts of external communication materials and sentiment analysis to market intelligence and peer group monitoring, AI’s impact on investor relations is undeniable.

However, to unlock AI’s potential, IR teams must remain attuned to developments in AI technology and keep pace with the wider investment community’s adoption of such tools.

A new landscape of informed decision-making

Investors are increasingly using AI, including Natural Language Processing (NLP) to analyse materials and, ultimately, inform investment decisions so it was interesting to see that a staggering:

90% of survey respondents have never used AI tools to analyse their investor communications materials

96.8% have not examined their results calls or investor presentations for tone of voice and/or body language.

This gap in leveraging AI-generated insights leaves IROs uninformed of vital information that investors might be employing, thereby exposing them to potential hidden risks.

Preserving the human aspects of IR amidst AI integration

A resounding theme prevails – not only in our survey findings but through the conversations we have with IROs, analysts and investors: while AI’s growing influence on the investment community is undeniable, the fundamental human dimension of investor relations remains irreplaceable. This is particularly evident in relationship-building, trust, and nuanced communication. IROs concur that personal connections, access to management, empathy, and the art of translating corporate strategy into investor-friendly language are dimensions that AI cannot adequately replicate.

Navigating data challenges

While AI’s extensive capabilities are apparent, certain challenges exist relating to data confidentiality and protection, as well as concerns around the quality of AI-generated information. So, it’s no surprise that almost a fifth of our respondents referenced the existence of an established policy for the responsible use of AI and an additional fifth have a policy in development. The absence of policies among two thirds of respondents raises concerns about the potential governance risks companies face by not setting out clear guidelines for the use of AI by employees.

Striking the balance

As AI continues to impact the investment community and the role of investor relations, it’s key that IR professionals strike the right balance between embracing technology in a considered manner and preserving the essence of human connection. By doing so, they can pave the way for a future where AI augments their capabilities, allowing them to serve investors with greater efficiency, accuracy, and depth of insight.

If you have any questions or queries, please do drop us a line: hello@citigatedewerogerson.com

Green shoots of recovery are already visible. For instance, Cava, a fast-casual Mediterranean restaurant chain, made a noteworthy debut on the New York Stock Exchange, raising $318 million on an oversubscribed book and witnessing a staggering 117% share price increase on its first trading day. Similarly, Johnson & Johnson’s consumer business, Kenvue, achieved a valuation of approximately $47 billion, establishing itself as the largest US IPO since 2021.

Another significant example is Softbank’s chipmaker, Arm Holdings, which has reportedly filed to sell its shares on NASDAQ. This highly anticipated IPO is targeting a valuation of $50 – $60 billion and aims to raise $8 – $10 billion, injecting further enthusiasm and investor appetite into the already active US IPO market.

Even this week it was reported that private equity owners of German sandal maker Birkenstock are considering an US IPO which could be valued by as much as $8bn.

Barrett Daniels, US IPO co-leader at Deloitte, emphasizes that these success stories are part of an emerging trend. In fact, by his estimations there are over 1,000 companies worth more than $1 billion eagerly await their turn to go public in the US. As market sentiment continues to climb, Daniels predicts that these companies may make their move sooner rather than later.

Recent developments also highlight the US IPO market’s favorable conditions compared to Europe and Asia. While inflation remains persistent in those markets, the US benefits from more favorable economic conditions, with the Federal Reserve’s cautious approach and declining inflation.

Moreover, the US market’s success can be attributed to its streamlined and investor-focused framework, setting it apart from Europe’s stringent regulations which are increasingly being criticized for being overly bureaucratic and as unfriendly to businesses

Similarly, the absence of a unified IPO framework across countries in Asia, creates protracted and often complex listing processes deterring potential IPO candidates from listing there. As a result, companies seeking streamlined and investor-friendly markets often turn their attention elsewhere.

The global capital raising environment remains competitive, however. Start-ups are still having to carefully strategize how to set themselves apart from te competition. Though the tools at their disposal remain largely unchanged, the high level of competition demands perfect execution.

Therefore, the positive momentum in the US IPO market compared to that of Europe and Asia cannot be overstated. Companies are naturally inclined to fundraise where they have the highest chances of success. While it remains to be seen if the US will retain its attractiveness as the most sought-after IPO market post-pandemic, the outlook continues to be optimistic for the sector, and we remain eager to observe its developments with great interest.

As a global agency we are fully aware of the different market dynamics when it comes to IPOs and can advise our clients accordingly wherever they choose to list.

Globally, the family office market is forecast to grow to USD 16.71 billion in revenue in 2025, from USD 11.08 billion in 2019. According to data from Forbes, New York City has the most billionaires in 2023 at 101 people, followed by Hong Kong with 70 billionaires, and Beijing with 68 billionaires, and this concentration of wealth is making Hong Kong the emerging regional hub for family office business.

When family offices decide where to set up their operations and locate their investments, tax treatment is often a key factor influencing their decisions. However, there is a geographical component too: Hong Kong is strategically situated within North Asia and is a gateway to the Greater Bay Area and China as a whole making it a top choice for families looking to tap into opportunities in this region.

While each family office may have different needs, there are some essential aspects that most family offices value: a sophisticated financial services environment, ease of doing business across borders, and convenience of communication and travel. However, a family office is more than just about investing. It is also about passing on and enriching a family legacy, which includes educating the next generation on topics such as family governance, entrepreneurship, and philanthropy.

Philanthropy, in particular, is a growing focus for Asia’s Ultra-High-Net-Worth Individuals (UHNWIs), as they allocate more of their wealth to good causes. Many family offices now seek to combine capital preservation with supporting broader societal value and solutions to pressing global problems and next generation heirs are particularly keen to steer family office investments to ESG and sustainability themes. However, most family offices are ill-prepared for the demands of greater transparency, public scrutiny and crises.

As family office profiles and influence skyrocket, the ever-increasing demand for transparency and information exchange is a growing concern for more than half of family offices. As this trend continues, controlling the narrative, internally and externally, is becoming imperative. To this end, families are starting to borrow from the playbook of asset managers, investment banks and corporates to deploy sophisticated communications strategies to better access investment opportunities, attract talent and manage reputation.

Private market investors transformed their communications approach in response to growing competition, regulation and public scrutiny, and family offices are now doing the same. As in private equity, family offices should tell their story through their portfolio companies. By communicating the positive impacts of their investments in operating businesses, family offices can craft a reputation as desirable investors and responsible community members, improve access to deals and talent, and mitigate negative attention.

To do this successfully, family offices need to identify relevant journalists to help them tell their stories. However, they must build media relationships before they need them. The default position of many family offices is to hire communications advisors after a crisis strikes. Families should engage advisors before a crisis occurs and develop a plan that assesses potential risks, anticipates future issues and sets out the operating principles and practices for a variety of possible scenarios.

Family offices should also be doubling down on creating their own content to complement the information they share through the media. This could include content about their investment approach, specialism or sector focus, information about their investment portfolio, and stories about the business, philanthropic or personal interests of the principals.

As family offices open up about their objectives, investment approaches, and philanthropic activities, they become relatable to their stakeholders and employees, the media, those seeking investment and the greater public. This allows them to craft their reputations as desirable employers and investors as well as responsible and engaged citizens who want to make a positive impact in the world.

Over the past few years, the demand and sophistication of wealth management solutions by UHNWIs in Asia has increased, giving rise to the emergence of family offices as key players in the region’s economic scenario, and the evolving role of these organizations and the growing responsibilities they take on present new strategic challenges from the point of view of communication and public affairs.

Family offices need to reorient their thinking to focus on larger strategic goals, including transparency, effective communication and reputation management. Those who continually focus on integrating them across their organizations will find themselves in better positions to face the challenges and take advantage of the opportunities that present themselves in the coming years.

An observer might be forgiven for thinking that activist hedge funds are financial markets’ carnivores, red in tooth and claw, that positively relish the chase and the kill.

But almost invariably, a public campaign is a last resort for an activist investor, a course only embarked upon after their previous attempts with the company’s management to achieve change behind closed doors have failed.

Many activists will say that they prefer to think of themselves as ‘constructivists’ or ‘suggestivists’ that are aiming only to provide good ideas to management, indeed that they are a source of free management consulting.

Indeed, the ideas need to be good because it is usually the views of the other investors in the company that matter most, and they who need to be convinced of any change of strategy.

So a successful activist campaign has to win hearts and minds and ultimately needs to be seen as increasing shareholder value for the company’s shareholders as a whole.

Therefore, it is not the most aggressive campaign that is likely to win, but the one that is most sensible. The loudest voice doesn’t win, the most reasonable one does.

That is why any company seeking to defend itself from an activist campaign will typically seek to paint the activist as acting in its own, short-term interests, rather than the interests of shareholders as a whole.

And it is why an activist attempting to gain traction for a change of corporate strategy has to demonstrate what is going wrong and explain how they can fix it.

To do so, they will have to demonstrate that they understand the company better than its own management. It is not so absurd as it sounds. Some management teams have admitted they were astounded how much detail activists had gone into and how they knew things management did not.

But does this all really deliver results? Academia is divided. “Governance by Persuasion: Hedge Fund Activism and Market-Based Shareholder Influence”, published last year by distinguished academics Alon Brav, Wei Jiang and Rongchen Li, argues that “the empirical evidence supports the conclusion that interventions by activist hedge funds lead to improvements in target firms, on average, in terms of both short-term metrics, such as stock value appreciation, and long-term performance, including productivity, innovation, and governance.”

But “Barbarians Inside the Gates: Raiders, Activists, and the Risk of Mistargeting” by Zohar Goshen and Reilly S. Steel in the Yale Law Journal, comes to a quite different conclusion.

They argue that “the conventional wisdom about corporate raiders and activist hedge funds—raiders break things and activists fix them—is wrong. Because activists have a higher risk of mistargeting—mistakenly shaking things up at firms that only appear to be underperforming—they are much more likely than raiders to destroy value and, ultimately, social wealth.”

Regardless of who is right, one thing is clear. An activist campaign is won and lost in the public domain. To prevail, the winning side must influence the influencers, ie they must explain their case to the journalists writing about it better than the other side.

Christen Thomson is a Senior Director at Citigate Dewe Rogerson specialising in hedge funds

Imagine my surprise, then, when I found myself immersed in Coldplay’s Sustainability Report. Yes, you read that correctly—the British pop band that has dominated the charts for over 20 years has produced a comprehensive sustainability report ahead of their current tour. What’s more, it is refreshingly simple, thorough, and ambitious, qualities often lacking in corporate ESG messaging. It involves the entire value chain and discusses tangible goals, empowering the reader to make a difference.

Measurement and Alignment

The first aspect that caught my attention in the report was the emphasis placed on measurement, processes, and alignment with internationally recognised frameworks. Coldplay has adopted the United Nations Framework Convention on Climate Change (UNFCCC), benchmarked their current tour against the previous one, and set clear goals to reduce their CO2 emissions by 50%. They have also outlined various initiatives and partnerships that are enabling them to reach these goals, providing transparency and accountability essential to a robust sustainability policy.

In ESG reporting, the validation of a third party with authority in the space helps legitimise your approach. While many businesses use organisations such as B Corp or the Science-Based Targets initiative (SBTi), Coldplay had their report assessed and validated by John E. Fernandez, Director of the Environmental Solutions Initiative at MIT. By ratifying the methodology for the report with a respected thought leader in the field, it lends confidence to the example being set.

Refreshing Clarity

Another remarkable feature of Coldplay’s report is its clarity. Sustainability reports often tend to be dense and difficult to navigate, filled with complex jargon and technical language. Coldplay breaks away from this trend by presenting their report in a clear and concise manner accessible to all readers. They offer a well-structured overview that highlights key achievements, challenges, and future goals.

By simplifying the language and focusing on the essential information, Coldplay ensures that their message reaches a wider audience. This approach not only enhances transparency but also fosters engagement and encourages stakeholders to follow their example and take action.

Inspiring Action

Coldplay’s sustainability report goes beyond mere numbers and statistics. It tells a compelling story that inspires their stakeholders and audiences to become agents of change. The report emphasises the band’s commitment to reducing their carbon footprint, supporting renewable energy projects, and promoting social justice initiatives.

Moreover, Coldplay’s report doesn’t shy away from acknowledging their challenges and areas for improvement. By being honest about their shortcomings, they demonstrate their willingness to learn and grow. This level of transparency is vital for fostering trust with stakeholders and encouraging other businesses to do the same.

Translating Clarity into Business Reporting

As a communications professional, I wonder how corporations can learn from the approach taken by this pop band. Here are a few key takeaways:

Coldplay’s sustainability report goes beyond being a mere documentation of their environmental efforts. It sets a powerful precedent, not only for the music industry but for all those seeking to communicate their sustainability and ESG initiatives. By prioritising clarity, inspiring action, and embracing transparency, Coldplay showcases the positive impact that a well-crafted sustainability report can have on stakeholders and the wider community.

Join us as we explore the evolving landscape of retail investors and the communication strategies required to engage with them effectively. In our first episode of CDR’s new insights series, People Opinion Perspectives (or POP for short), we speak with James Deal, co-founder of PrimaryBid, and Sandra Novakov, Head of Investor Relations at CDR, as they share their insights and experiences in dealing with the challenges and opportunities of engaging with this growing faction of the investment community.

The conference, hosted once again by journalist Evan Davis, had a wide-ranging agenda and an impressive line up of speakers and panellists from CEOs (from TalkTalk and Informa) and IROs (including those from British Land, GSK, Haleon, LSEG, Redde Northgate and Segro), to fund managers (from Invesco, Legal & General Investment Management and Norges Bank) and bankers (including from Bank of America, Credit Suisse and Goldman Sachs).

Perhaps unsurprisingly, given its rapid rise in recent months, AI was the thread that ran throughout the sessions, replacing ESG as the hot topic in previous years. While Goldman Sachs economist, Fillippo Taddei, reported that 25% of tasks we currently do could be replaced by AI, the consensus view throughout the conference was that human interaction can’t be replaced or replicated.

Despite being relegated to second place by AI, ESG clearly remained an important theme throughout the conference. But perhaps in a more embedded way than in the past, giving credence to the view that it is succeeding in becoming integrated. While the ‘E’ remains more of a standalone topic – with a panel session dedicated to TCFD and scenario analysis – the lines are more blurred when discussing ‘S’ related themes. In the wake of the CBI and Crispin Odey scandals, the handling of matters such as these arose in conversation. In his opening remarks, Evan Davis, with reference to the #metoo movement, noted that “often, the handling of [an incident] gets judged more than the occurrence itself” and in a later fireside chat, Sanjay Nazerali (Brand President, dentsu X) commented that “people don’t mind mistakes as much as the cover up” reinforcing the importance of authenticity, accountability and transparency from companies and the individuals running them.

Another theme that emerged through many of the conversations was the importance of clarity. Hardly a surprising observation, but one that was made most notably by the panel of investors who urged companies to simplify messaging and make content digestible and accessible to generalist portfolio managers.

At an event dominated by listed-company representatives, it was fascinating to hear from Tristia Harrison, CEO of TalkTalk which was taken private in 2021. Having begun her career in investor relations, and having led TalkTalk as a listed business, her observation of IR for a private company is that “it’s not really different” as the core principles of good governance and transparency still apply. She did, though, concede that it can be “easier to do some things out of public glare.”

While delegates from private companies will have been unlikely to join the ‘consensus management’ panel discussion, it was a well-attended session covering the use of consensus management tools, the importance of intra-period communication for short term expectation management and broader capital markets events for longer term prospects and the potential of AI around the qualitative aspects of managing consensus (but not the quantitative ones!).

Through the fireside chat with Informa’s CEO, Stephen Carter, it was evident how much value he, and the company, placed on IR. Looking back on the outset of Covid, he reflected that when turning to debt and equity investors to raise capital, the relationships they had really mattered. The fact that investors knew them well and trusted management counted for a lot, commenting that they were “100% in a better position because of good IR in the past.”

There was so much valuable content covered over the course of the day, it’s impossible to summarise it, but some of the top practical take-aways we wanted to share are:

The prospect of reputationally damaging lawsuits is cited as the reason behind one investment bank pulling funding for new gas projects. Then there are employers like P&O Ferries who dismissed staff via video call and text message. P&O quickly found themselves in the firing line – with litigation around unfair dismissal. The E, the S and the G are becoming ever more entwined – and litigation is becoming a common theme.

With increased scrutiny and stricter regulatory requirements regarding ESG disclosures, the risk of litigation for companies in breach of regulation is rising. Good governance is essential and in our view there’s an opportunity for communicators to work closely with legal counsel to advise what companies need to prepare and mitigate risk.

Last week CDR and Clifford Chance convened an expert panel under Chatham House rules at the Royal Society of Arts to unpack what ESG litigation is, the trends, role for communicators and how individual Directors can find themselves as much at risk as the company they represent.

In the room? Senior communication leaders, regulatory experts to some of the UK’s largest listed companies as well as advisers to fast growing but sometimes resource constrained growth companies. For this latter group, interpreting the wave of ESG regulations remains a significant headache. So, what were some of the key things we heard?

What we mean by ESG litigation

“For many businesses risk will lie in a misalignment between their public claims and reality. The golden rule therefore is to say what you do, and do what you say.”

What are the big ESG litigation trends?

“This is a fast-changing landscape, the role of a Corporate Sustainability Officer didn’t exist the way it does today, 4-10 years ago.”

“Never allow anybody to say anything unless someone has decided this is true, know what you have said and if you set targets ensure there is a paper trail to substantiate this.”

The role for communicators

- Communications alone should not be viewed as a substitute for a carefully mapped out ESG strategy informed by a robust materiality analysis. Lorna Cobbett, CEO of CDR UK:

“Ultimately, it’s about accountability and how you manage your reputation. You also need to articulate the journey that you’re on with full transparency. Your audience goes beyond investors and every stakeholder needs to be considered.”

- It was also noted that ESG litigation is not always about financial action but can often be about challenging behaviours and holding companies (and individuals) to account for their actions.

- The digital world has also made an impact as there is now a permanent record of what a company has said and when. Doing due diligence on a company is enhanced by Natural Language Processing allowing anyone to see exactly what was said, when – and who actually said it.

- The consensus on the panel was that communicators with proximity to the board and ability to influence senior leaders gave them a key role to work alongside legal counsel to map the risks a client might be able to face. Eleanor Hervey-Bathurst, Associate at Clifford Chance:

“There can often be a discrepancy between sales teams who are keen to promote green credentials of products and the legal team who understand the burden that brings. Good communication between all parties including reputation advisers is vital to ensure that products do as marketed.”

Mitigating risk

- The good news is there is a path forward to safeguard reputation with ESG upskilling, mapping key stakeholders and engaging in the right way and the right time key to success. Roger Leese, Partner at Clifford Chance:

“The connection between the comms advisers, risk/compliance and legal team is pivotal when mitigating ESG risks. Ensure you engage with NGOs earlier and be transparent to mitigate the risks.”

- The organisation, Chapter Zero equips non-executive directors with skills and knowledge around the impact of climate change and what is needed to build robust plans and measurable action. Sharon Flood, Fellow at Chapter Zero says boardroom education is critical:

“There is a need to ensure companies can upskill their board of directors to meet ESG expectations.“

With new research this year from the World Business Council for Sustainable Development highlighting that lawsuits against companies concerning ESG issues have risen sharply, expect to see a continued focus on activities in the value chain, breaches of policy and regulatory frameworks (which are getting more stringent and at various stages at a national and supra-national level) and more cases around ‘softer’ laws such as biodiversity conventions, OECD guidelines and more. ESG litigation is not going away.

Huge thanks to our stellar panel for their contributions.